Maximizing Your College Cost Savings: Key Financial Preparation Approaches

As the price of university proceeds to rise, it becomes significantly crucial to develop efficient monetary preparation techniques to optimize your college cost savings. The path to college can be a discouraging one, filled with lots of economic challenges along the road. With careful preparation and factor to consider, you can pave the way for a brighter future without endangering your monetary security. In this conversation, we will certainly check out vital economic planning techniques that can assist you browse the intricacies of college financial savings and ensure you are well-prepared for the trip ahead. Whether you are a parent saving for your child's education or a student looking to money your own college experience, twist up and obtain ready to begin on an economic trip that will certainly shape your future.

Start Saving Early

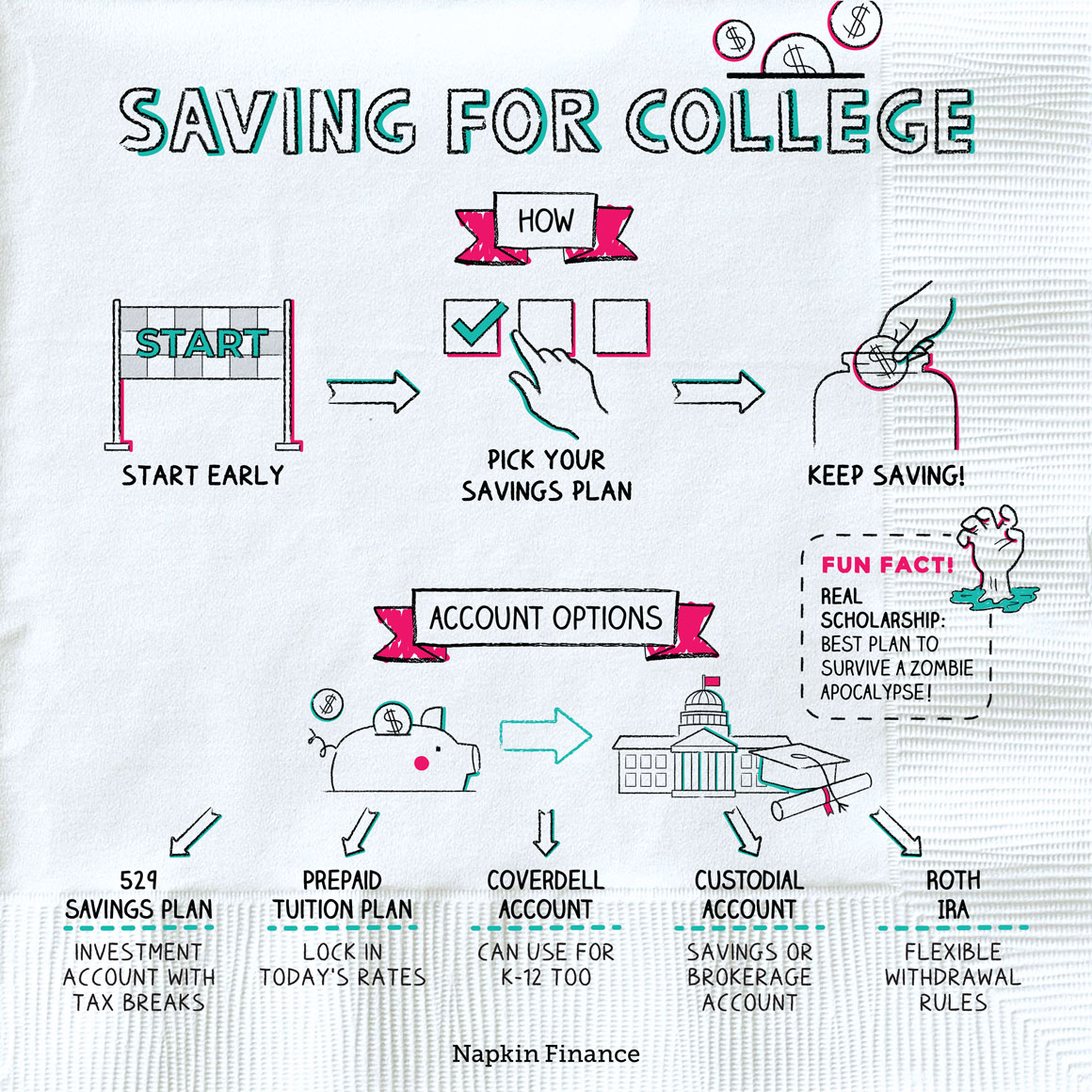

To take full advantage of the potential growth of your college financial savings, it is vital to begin saving early in your monetary preparation trip. Starting early allows you to benefit from the power of intensifying, which can significantly increase your financial savings gradually. By beginning early, you provide your cash even more time to benefit and grow from the returns created by your financial investments.

When you begin conserving for university early, you can likewise benefit from different tax-advantaged savings lorries, such as 529 plans or Coverdell Education Cost Savings Accounts. These accounts provide tax advantages that can aid you conserve better for university expenditures. Additionally, beginning early offers you the chance to contribute smaller sized quantities over a longer period, making it much more manageable and less difficult on your spending plan.

One more benefit of beginning early is that it enables you to establish sensible savings objectives. By having a longer time horizon, you can better plan and adjust your financial savings approach to meet your university funding demands. This can assist reduce tension and give peace of mind knowing that you get on track to achieve your savings goals.

Explore Tax-Advantaged Savings Options

529 plans are popular tax-advantaged cost savings choices that use a series of financial investment alternatives and tax obligation advantages. Payments to a 529 strategy expand tax-free, and withdrawals for certified education and learning costs are additionally tax-free. Coverdell ESAs, on the various other hand, permit contributions of up to $2,000 per year per beneficiary and deal tax-free development and withdrawals for certified education and learning expenditures.

Establish Reasonable Conserving Goals

Developing realistic conserving objectives is a necessary action in reliable financial planning for university expenses. It is vital to have a clear understanding of the expenses included and established achievable goals when it comes to conserving for university. By setting reasonable conserving objectives, you can ensure that you are on track here to fulfill your financial needs and stay clear of unnecessary stress.

To start, it is essential to approximate exactly how much you will browse around here need to save for university. Think about factors such as tuition charges, books, accommodation, and other various expenditures. Researching the typical prices of institution of higher learnings can provide you with a baseline for establishing your conserving goals.

When you have a clear idea of the quantity you require to conserve, simplify right into smaller sized, manageable goals. Establish annual or monthly targets that align with your current financial situation and revenue. This will certainly aid you remain determined and track your progression with time.

In addition, take into consideration utilizing tools such as college savings calculators or collaborating with a monetary consultant to obtain a much deeper understanding of your conserving possibility (Save for College). They can provide valuable insights and assistance on exactly how to enhance your savings approach

Consider Different Investment Strategies

When preparing for college savings, it is necessary to explore various financial investment approaches to make the most of the growth of your funds. Buying the right approaches can aid you attain your cost savings goals and offer financial security for your youngster's education and learning.

One typical investment technique is to open a 529 university cost savings plan. This plan supplies tax obligation advantages and allows you to buy a range of investment alternatives such as supplies, bonds, and shared funds. The earnings in a 529 strategy grow tax-free, and withdrawals used for certified education and learning expenses are additionally tax-free.

One more technique to consider is spending in a Coverdell Education Interest-bearing Account (ESA) Like a 529 plan, the earnings in a Coverdell ESA expand tax-free, and withdrawals are tax-free when utilized for certified education expenses. Nevertheless, the contribution restriction for a Coverdell ESA is lower contrasted to a 529 plan.

Capitalize On Scholarships and Grants

To better boost your university financial savings strategy, it is essential to maximize the chances provided by i thought about this grants and scholarships. Scholarships and gives are financial aids provided by various institutions and organizations to help pupils cover their university expenditures. Unlike scholarships, finances and gives do not require to be paid off, making them an exceptional choice to reduce the economic worry of greater education.

Scholarships are generally granted based upon advantage, such as academic success, sports capabilities, or artistic abilities. They can be provided by colleges, exclusive organizations, or federal government entities. It is crucial to research study and look for scholarships that straighten with your rate of interests and strengths. Several scholarships have certain eligibility requirements, so be sure to examine the due dates and requirements.

Grants, on the various other hand, are typically need-based and are given to students that show monetary demand. These grants can come from government or state governments, colleges, or exclusive organizations. To be thought about for gives, students commonly require to complete the Free Application for Federal Trainee Aid (FAFSA) to identify their qualification.

Making the most of gives and scholarships can significantly decrease the quantity of cash you need to save for college. It is important to start investigating and using for these financial assistances well in breakthrough to increase your chances of getting them. By very carefully considering your alternatives and placing in the effort to seek out gives and scholarships, you can make a substantial influence on your university savings strategy.

Final Thought

To conclude, maximizing college savings requires early planning and exploring tax-advantaged savings options. Setting reasonable saving goals and considering different financial investment strategies can additionally add to an effective financial savings strategy. Furthermore, capitalizing on grants and scholarships can even more reduce the financial burden of college expenditures. By applying these vital monetary planning techniques, individuals can guarantee they are well-prepared for their university education.

As the cost of university proceeds to rise, it comes to be progressively important to create effective monetary planning techniques to optimize your college savings. In this conversation, we will discover crucial financial preparation techniques that can aid you navigate the intricacies of college savings and guarantee you are well-prepared for the trip ahead.When you start saving for university early, you can likewise take benefit of various tax-advantaged financial savings cars, such as 529 strategies or Coverdell Education Financial Savings Accounts.As you consider the relevance of starting early in your university financial savings journey, it is critical to check out the numerous tax-advantaged savings choices available to maximize your financial savings potential.In final thought, making the most of university financial savings requires early preparation and exploring tax-advantaged cost savings choices.